GROWTH FUND

Overview

The Growth Fund is a profit and equity sharing fund. Passive members receive a 6% preferred return which starts as soon as your investment is received, and is distributed on the 15th business day of each month. Above the 6% preferred return, passive members receive 50% of the profit, which is distributed upon availability on a semi-annual basis. Passive members also receive 50% of the equity and 50% of the tax advantages. The expected duration of the fund is 5-7 years, with the ability to request redemption as early as year 3 or stay in past year 7. Capital liquidity is ideally created through regular refinances instead of the sale of properties as management’s goal is to continue to manage and grow the fund in perpetuity.

Strategy

Through our vertically integrated, technology driven in-house operations we acquire, redevelop, lease, and manage high demand affordable and workforce, scattered site single family rentals throughout the Mid-Atlantic Region, primarily in Pennsylvania, Maryland, and New Jersey. We acquire assets in these areas because we were born and raised in these areas and know the ins and outs of these markets well. We also have an extensive in-house construction and property management team built out in these areas. Our in-house construction and property management allows us to maintain full control over our projects. Our network of local real estate professionals allows us to consistently acquire discounted distressed and value add properties and our network of attorneys, local government and utility contacts help us successfully manage our portfolio.

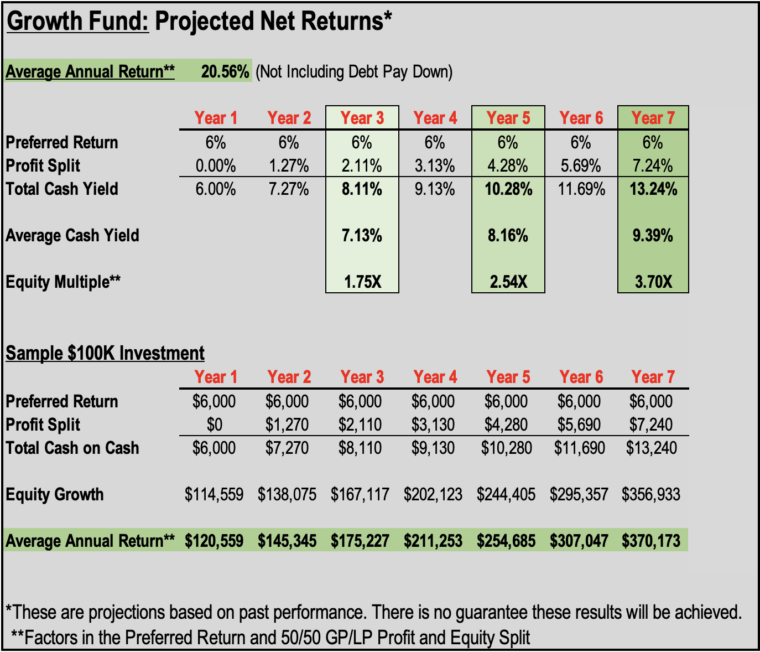

Projected Net Investor Returns

PITCH DECK

For more information on our company, track record, strategy, funds, model and more, please review our Pitch Deck.

WEBINAR

For more information on our company, track record, strategy, funds, model and more, please listen to this webinar.

__________________________________

OFFERING DOCUMENTS

Confidential Private Offering Memorandum

THE FOLLOWING EXHIBITS ARE INCLUDED:

- Exhibit A – Subscription Agreement

- Exhibit B – Accredited Investor Verification Process

- Exhibit C – Limited Liability Company Operating Agreement

- Exhibit D – Form W-9

- ACH Form

HAVE QUESTIONS OR READY TO START INVESTING?

Please use the box below to schedule time with Co-Founder and Managing Partner, Peter Neill.

We’re here if you have any questions. Call/text us anytime at 610-357-2330 or email Pneill@gsprei.com.