Balancing housing needs with dependable,

long-term income and growth for accredited investors.

Balancing housing needs with dependable,

long-term income and growth for accredited investors.

GSP REI is a vertically integrated investment manager focused on residential real estate across the Mid-Atlantic. We provide investors with consistent income through our rental portfolio and attractive growth through our land development platform.

The GSP REI Income Fund is designed for investors seeking consistent, asset-backed returns through single-family real estate. We acquire distressed and value-add properties and redevelop them for rental or resale. With flexible investment options starting at just $10,000, you can participate in a professionally managed fund built for consistent, asset-backed income.

| Fixed Return | Minimum Investment | Minimum Term |

|---|---|---|

| 8% | $10,000 | 12 Months |

| 10% | $25,000 | 24 Months |

| 12% | $50,000 | 36 Months |

| Fixed Return | Minimum Investment | Minimum Term |

|---|---|---|

| 8% | $10,000 | 12 Months |

| 10% | $25,000 | 24 Months |

| 12% | $50,000 | 36 Months |

Our Land Entitlement Offerings are built for investors seeking meaningful growth through residential land development. We acquire raw and underutilized land in supply-constrained markets, complete full entitlements for new communities, and either sell approved projects to national builders or develop them ourselves for our long-term rental portfolio. Backed by rigorous underwriting, local relationships, and experienced engineering and legal partners, this strategy allows investors to participate at the stage where value is created first; the land.

| Minimum Investment | $100,000.00 |

| Waterfall | European |

| Preferred Return | 10% |

| Investor/Manager Split | 80% / 20% |

| Targeted Projects | 5–6 Projects |

| Targeted Equity Multiple | 2X Minimum |

| Targeted IRR | 20% Minimum |

| Targeted Hold Period | 3–5 Years |

| Distributions | Upon Capital Events |

We acquire and redevelop single-family homes in areas with significant supply constraints and strong demand for workforce and affordable housing. Our approach targets both individual scattered-site properties and portfolios of distressed or value-add homes. This strategy allows us to balance consistent long-term rental income with selective short-term sales opportunities.

We generate strong returns by acquiring properties below market value through diverse channels such as:

With in-house construction and property management, we maintain complete control over the entire redevelopment cycle. This enables us to minimise risk, reduce costs, and ensure strict adherence to timelines and quality standards.

This strategy has been refined over more than twenty years of experience working for and with some of the top national and regional homebuilders and land developers. A few of our key differentiators include:

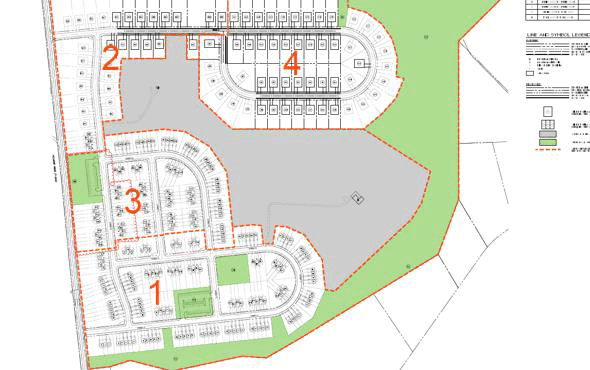

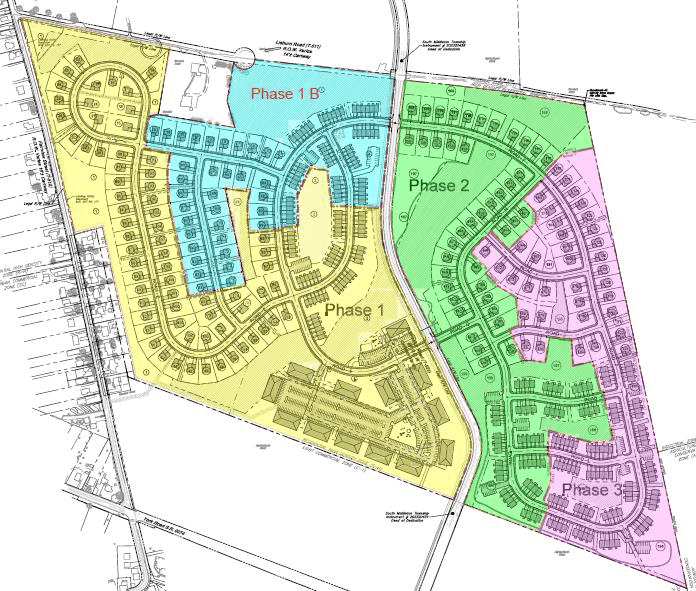

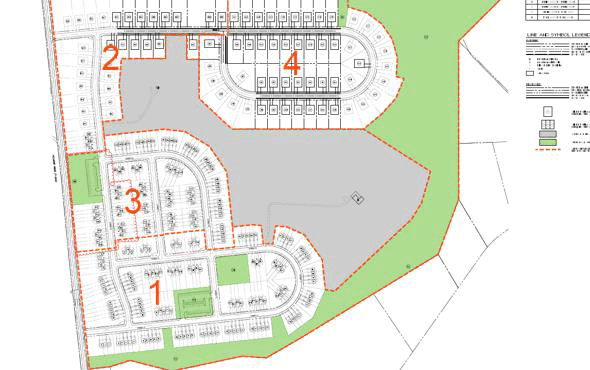

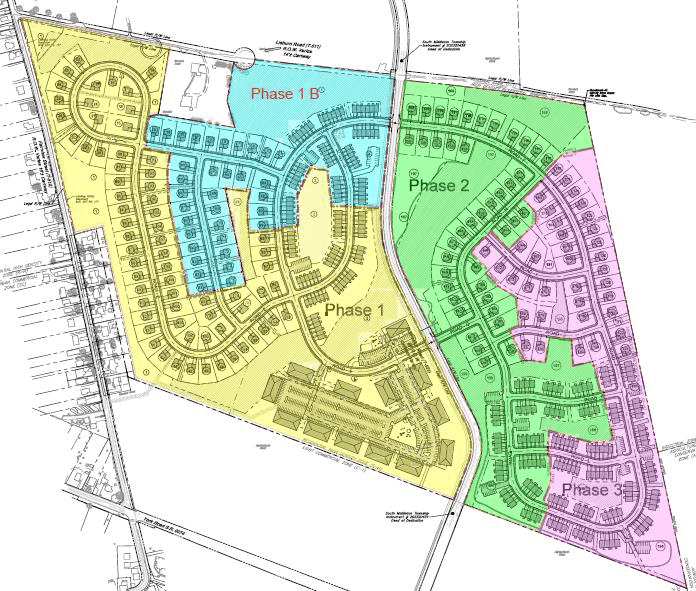

We control raw and underutilized land through an Agreement of Sale in areas with high housing demand and limited housing and lot supply. We work closely with municipalities, counties, state agencies, and third party regulators to secure all necessary entitlements and approvals for new residential communities. Once approvals are in place, we sell the entitled land to national homebuilders or develop and build in-house for our long-term rental portfolio.

This strategy has been refined over more than twenty years of experience working for and with some of the top national and regional homebuilders and land developers. A few of our key differentiators include:

With a rigorous focus on mitigating risk, these offerings are designed for investors seeking access to an institutional-quality strategy and approach, positioned at the earliest stage of value creation. It offers the potential for strong, tax-advantaged growth, multiple exit strategies, and exposure to a segment of real estate that is typically not accessible to most investors.

This strategy has been refined over more than twenty years of experience working for and with some of the top national and regional homebuilders and land developers. A few of our key differentiators include:

We control residential-zoned raw land through an Agreement of Sale in areas with high housing demand and limited housing and lot supply. We work closely with local municipalities to secure all necessary entitlements and approvals for new residential communities. Once approvals are in place, we sell the entitled land to national homebuilders.

This strategy has been refined over more than twenty years of experience working for and with some of the top national and regional homebuilders and land developers. A few of our key differentiators include:

With a rigorous focus on mitigating risk, this fund is designed for investors seeking access to an institutional-quality strategy and approach, positioned at the earliest stage of value creation. It offers the potential for strong, tax-advantaged growth, multiple exit strategies, and exposure to a segment of real estate that is typically not accessible to most investors.

| Criteria | Income Fund | Land Entitlement Offerings |

|---|---|---|

| Asset Class / Collateral | Single-Family Homes | Raw and Underutilized Land |

| Structure | Pooled Fund | Individual Project Syndications |

| Strategy | Renovate, Lease and Manage / Renovate and Sell | Secure Permits and Approvals for New Community. Sell Approved Land to National Homebuilders or Develop and Build In-House. |

| Minimum Investment | $10,000–$50,000 | $25,000 |

| Targeted Returns | 8–12% Fixed Returns | 2x Equity Multiple minimum / 20% IRR minimum |

| Focus | Income | Growth |

| Distributions | Monthly or Compounding | Upon capital events (2–5 years) |

| Term | 1–3 years (Fixed) | 2–5 years |

| Tax Treatment | Ordinary Income — No UBIT in SDIRA | Project Specific |

| Criteria | Income Fund | Land Entitlement Offerings |

|---|---|---|

| Asset Class / Collateral | Single-Family Homes | Raw and Underutilized Land |

| Structure | Pooled Fund | Individual Project Syndications |

| Strategy | Renovate, Lease and Manage / Renovate and Sell | Secure Permits and Approvals for New Community. Sell Approved Land to National Homebuilders or Develop and Build In-House. |

| Minimum Investment | $10,000–$50,000 | Project Specific |

| Targeted Returns | 8–12% Fixed Returns | Project Specific |

| Focus | Income | Growth |

| Distributions | Monthly or Compounding | Upon Capital Event |

| Term | 1–3 years (Fixed) | Project Specific |

| Tax Treatment | Ordinary Income — No UBIT in SDIRA | Project Specific |

Both offerings are strategically designed to meet investors’ unique income and growth needs. The Income Fund is built to deliver consistent, asset-backed monthly cash flow, while our Land Entitlement Offerings are focused on tax advantaged, asset-backed growth by creating tremendous value at the earliest stage of real estate development.

Schedule a call with our team to discuss your passive investing goals and determine which option is the best fit for you.

We are a diversified, tech-driven, residential-focused real estate investment firm based in the suburbs of Philadelphia, operating throughout Pennsylvania, Maryland, and New Jersey. Our team includes seasoned investors, developers, and construction, property, and asset managers dedicated to keeping our projects on time and on budget while delivering high-quality alternative investment opportunities to our investors.

Our investment philosophy is simple: generate strong returns with as little risk as possible. We achieve this through our vertically integrated structure, regional expertise, and highly experienced team and partners.

Weekly Webinars, Podcast, In-Person Meet Ups, Real Time Market and Asset Class Updates, Stories, Insights, and Strategies from the Front Lines of Real Estate Investing and Land Development.

Stream now on your favourite platform

Connect with like-minded accredited investors and gain access to monthly webinars, weekly podcast episodes, in-person meetups, real-time market and asset-class updates, plus stories, insights, and strategies from the front lines of real estate investing and land development.

Stream now on your favourite platform

Most people only hear the success stories not the costly errors that kill returns. Our free guide, How to Create Stress and Lose Money in Real Estate, reveals the top mistakes and how to avoid them so you can grow wealth without the headaches.

We know investing can feel complex, so we’ve made it simple. Here are straightforward and easy to understand answers to the questions investors ask us most often.

We know investing can feel complex, so we’ve made it simple. Here are straightforward and easy to understand answers to the questions investors ask us most often.

Have other questions?

Our Income Fund invests in distressed and value-add Single-Family Homes for long-term rental income or quick resale profit.

Our Land Entitlement Offerings invest in raw and underutilized land, securing entitlements and approvals for a new residential community, and selling that approved land to national home builders or developing and building in-house for our rental portfolio.

Our Income Fund has a $10,000 minimum investment, depending on the term and return tier selected.

Our Land Entitlement Offerings have a $25,000 minimum investment.

Income Fund Investors can choose to receive monthly cash distributions or allow their returns to compound for higher overall growth.

The Land Entitlement Offerings typically make distributions upon capital events. This means that when a project sells, investors receive a distribution, which generally occurs within 2–5 years, depending on the project.

All investments are secured by real assets. Our Income Fund investors are collateralized by a portfolio of single-family rentals and resale properties. Our Land Entitlement Offering investors are collateralized by controlling positions and/or ownership in land.

Our offerings are 506c offerings. We cannot and do not guarantee returns. Investing involves serious risk which are spelt out in our offering documents.

The Income Fund provides fixed-rate returns, structured to deliver steady, interest payments ranging from 8–12% annually, depending on the investment amount and selected term.

Our Land Entitlement Offerings are structured as individual project syndications, which means returns vary from project to project. We generally target a minimum 2X equity multiple and a 20% IRR for our investors.

Yes. All our offerings provide quarterly financial statements and hold quarterly investor review calls with our management team. Also, through our Investor Community we provide consistent insights and updates on our portfolio, markets, and investing.

Simply fill out our investor form on the offerings page and schedule a call with our team. We will review any questions you have, walk through the offering documents with you, and guide you through the subscription and accredited investor verification process.

Yes. All of our offerings are 506c offerings. This means we can generally solicit our offerings and openly discuss the details through our website and presentations. However, this requires us to have documentation on file showing you are an accredited investor.