Land Entitlement

Capture Value Where It Begins. Individual Project Syndications.

WATCH OUR LATEST INVESTOR PRESENTATION

Our Strategy

Control. Entitle. Exit OR Build.

We control raw and underutilized land in high demand markets. Our team works closely with municipalities, counties, state agencies, and third party regulators to secure all permits and approvals, also known as entitlements, required for new residential communities.

Once approvals are in place, we sell the entitled land directly to national and regional homebuilders, capturing maximum value or we develop and build in-house for a rental portfolio.

10%

Preferred Return

20%+

IRR Target

2X+

Equity Multiple

Acquire

Secure raw land in supply-constrained markets.

Entitle

Engineer, design, and obtain zoning, permits, and approvals.

Exit

Sell approved land to homebuilders at a premium.

Build

Select projects we build, lease, and manage in our portfolio.

Land Entitlement Fund

Now Open to Accredited Investors

The GSP REI Land Entitlement Fund is designed for investors seeking strong growth potential through residential land development. We acquire raw land in supply-constrained markets, secure full entitlements for new communities, and sell approved projects to national builders. With a disciplined, professionally managed approach shaped by more than 20 years of experience with national and regional homebuilders and land developers, the fund gives investors access to a proven strategy that captures value where it is created first, at the land stage.

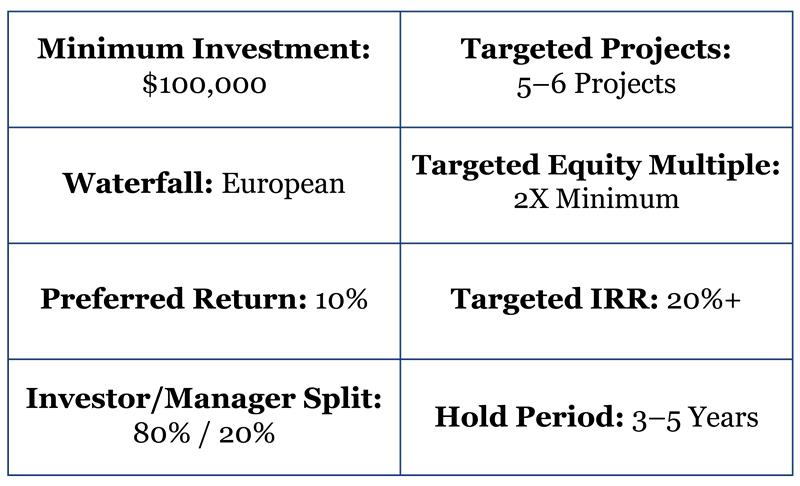

| Minimum Investment | $100,000.00 |

| Waterfall | European |

| Preferred Return | 10% |

| Investor/Manager Split | 80% / 20% |

| Targeted Projects | 5–6 Projects |

| Targeted Equity Multiple | 2X Minimum |

| Targeted IRR | 20% Minimum |

| Targeted Hold Period | 3–5 Years |

| Distributions | Upon Capital Events |

- Financial Statements are provided quarterly.

- Financial Review Calls with Management are held quarterly.

Join the Waitlist

Please complete the form below to join the waitlist for our land entitlement offerings and schedule a call with Peter Neill, GSP REI Co-Founder & Partner to learn more.

The GSP REI Land Entitlement strategy provides accredited investors with access to an institutional-quality land development approach typically targeting double-digit plus returns.

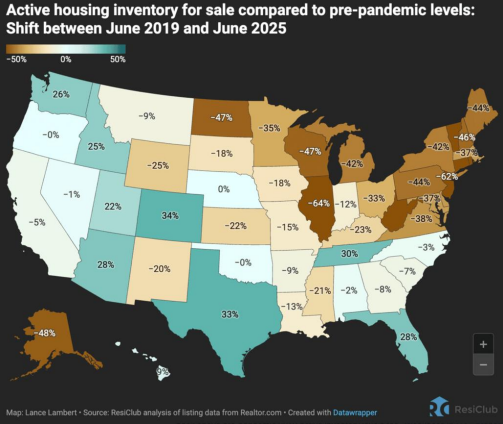

The Housing Problem

The U.S. housing market is in crisis. Homebuilders cannot keep up with demand, and the entitlement process for new residential communities is long and complex.

-

In Pennsylvania and surrounding states, demand exceeds supply by 10,000–20,000 units annually

Hallowfield Land Entitlement Fu… - New approvals can take 2–3 years, plus another 1–2 years for site improvements and construction.

- National and regional homebuilders depend on land developers to deliver shovel-ready projects.

Result: Approved lots are scarce and command a premium - making the entitlement stage the most profitable point of the development cycle.

Our Strategy

Control, Entitle, Exit.

We control residential-zoned raw land through Agreements of Sale in high-demand markets. Our team works closely with local municipalities to secure all entitlements and approvals required for new residential communities.

Once approvals are in place, we sell the entitled land directly to national and regional homebuilders, capturing maximum value while avoiding costly vertical construction risks.

Acquire

Secure raw land in supply-constrained corridors.

Entitle

Engineer, plan, and obtain zoning, permits, and approvals.

Exit

Sell shovel-ready land to homebuilders at a premium.

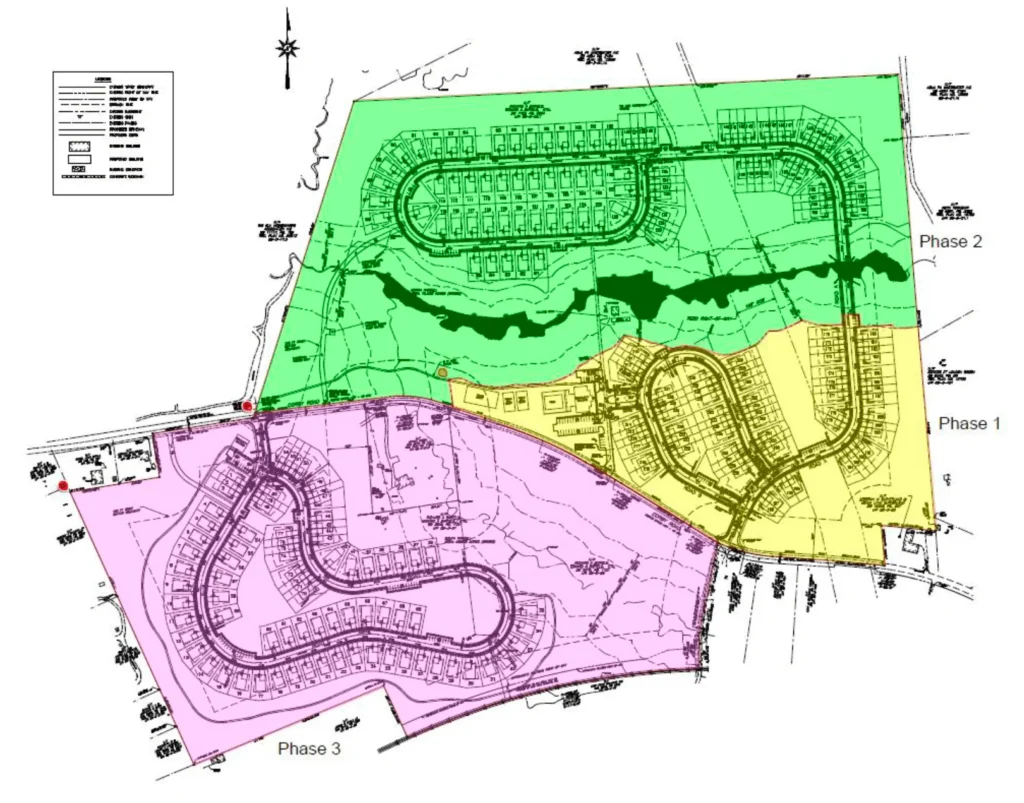

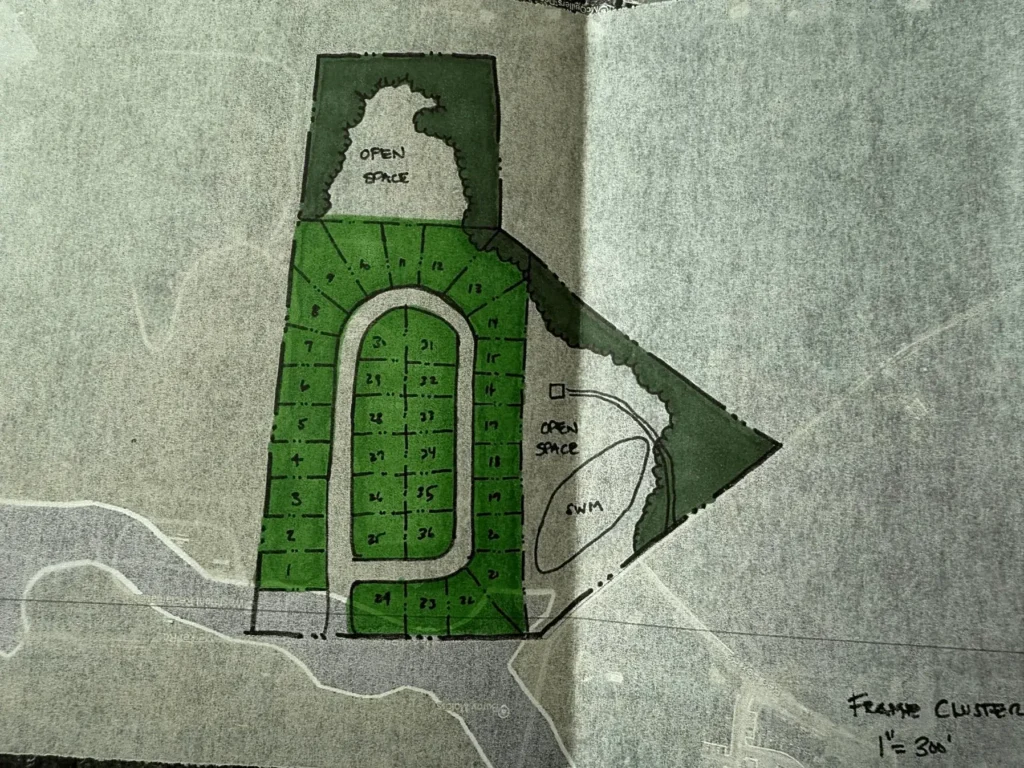

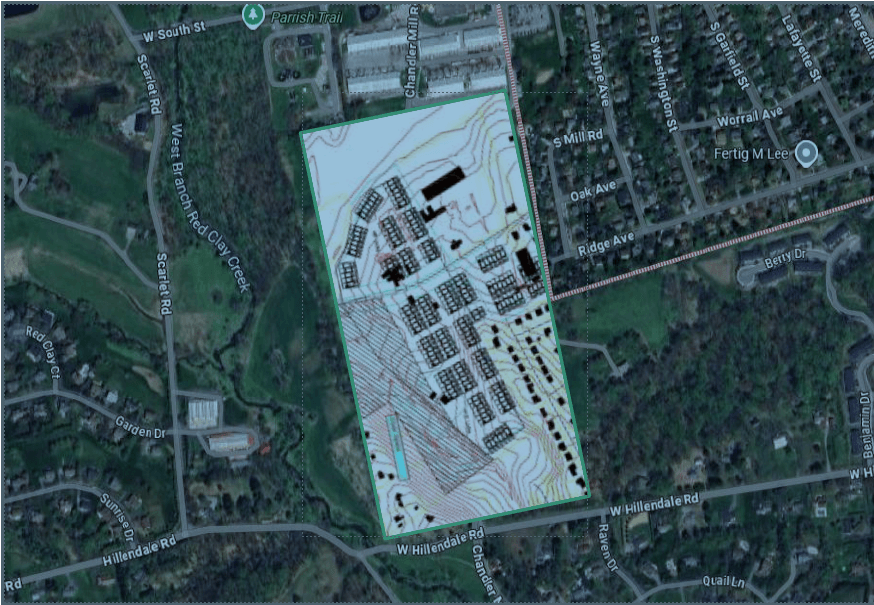

Our Process: The Entitlement Journey

We follow a proven, step-by-step entitlement process to unlock value from raw land while reducing risk:

- Analyse market, zoning, comps, supply/demand.

- Conduct property and zoning risk assessment with sketch plans.

- Prepare pro forma to validate financial viability and projected returns.

- Submit LOI after initial due diligence.

- Negotiate purchase agreement and secure property under contract.

- Ensure fair and effective terms that protect investor capital.

- Rigorous investigation to identify risks and validate assumptions.

- Commission only necessary studies to make smart, calculated decisions.

- All due diligence exits require approval from the Advisory Board.

- Work with civil engineers to design high-demand communities.

- Navigate municipal approvals (Conditional Use, Preliminary, Final Plans).

- Secure all permits for stormwater, traffic, and environmental compliance.

- Solicit offers from trusted builders/developers before final plans.

- Upon record plan approval, assign contracts to builders for a fee.

- Exit cleanly without taking on costly vertical construction.

Our Approach: Risk Mitigation

Protecting investor capital is at the heart of our strategy:

No Title Risk

In this strategy we typically do not take title to land. We control it under contract, eliminating depreciation or “bad asset” risk.

Assignment Strategy

Projects are assigned to third-party builders at closing, avoiding transfer tax and acquisition costs.

Buyer Identification

We engage prospective buyers early to ensure demand for entitled projects.

Equity-Focused

Projects are typically equity only; no debt is employed unless horizontal/vertical development offers clear benefits that outweigh risks.

Exit Flexibility

Multiple strategies are built in (assign, sell at record plan, or syndicate development if more profitable).

Bottom Line: We put land under contract, entitle it, and sell at a premium once approvals are in place — while keeping multiple exit strategies in play to protect and grow investor equity.

Our Expertise

- Identifying highly desirable, undeveloped land suitable for residential communities.

- Performing extensive property analysis, risk mitigation, and due diligence to validate assumptions.

- Designing high-value communities while navigating approvals and regulatory permits.

- Assigning approved/unimproved communities to homebuilders and developers for profit.

Acquisition Criteria

We target value-add land opportunities in high-demand areas with:

- Land zoned for residential (or suitable for rezoning).

- Access to public utilities (water, sewer).

- Desirable school districts, transportation, and proximity to major employers.

- Residential zoning options: Townhomes, Single-Family Homes, Active Adult, Small Multi-Family, Large Apartments.

Why This Fund

- Proprietary 16-Point Risk Analysis Calculator : tested over 20+ years.

- Defined Target Market : land-constrained, high-demand regions.

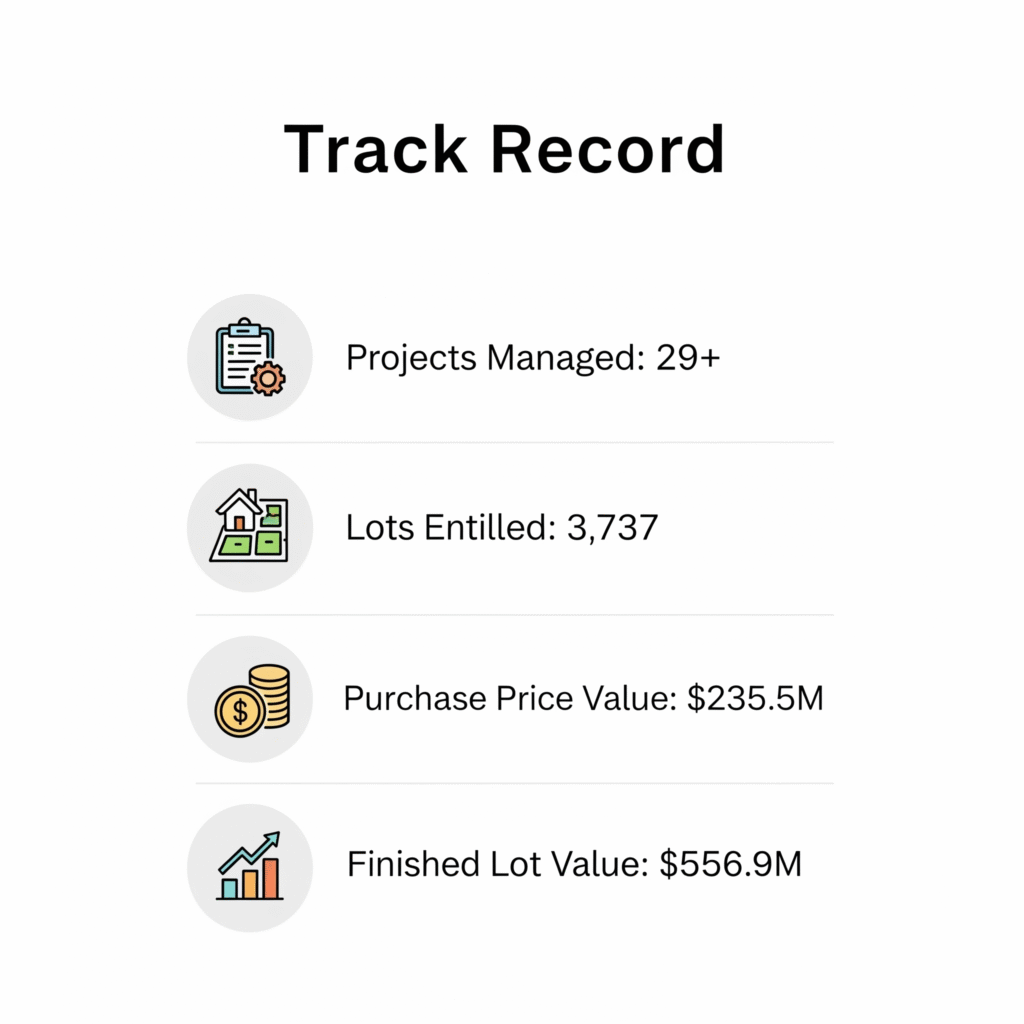

- Experienced Team : thousands of lots entitled, $321M+ land value created..

- Multiple Exit Strategies : structured to mitigate risks and protect investor capital.

- Tax-Advantaged : structured for long-term capital gains.

The Edge That Sets Us Apart

Proprietary 16-Point Risk Analysis Calculator

tested over 20+ years.

Experienced Team

thousands of lots entitled, $321M+ land value created.

Defined Target Market

land-constrained, high-demand regions.

Multiple Exit Strategies

structured to mitigate risks and protect investor capital.

Our Expertise

Investor Reporting

- Quarterly financial statements

- Quarterly investor review calls with management

- Annual K-1 tax documents (by March 15)

Our Team

A leadership group with decades of land entitlement and fund management experience:

Matt Caffrey

PETER NEILL

Nate Niles

RON LOCKHART

WADE CARROLL

Ready to Invest?

Join a fund designed for predictable income and long-term wealth building.